Some companies our

team has worked with:

Inbound Lead Qualification

Capture business information, monthly revenue, and funding needs over the phone.

Application Status Updates

Notify borrowers of missing documents, approval updates, and next steps.

Document Collection & Reminders

Call borrowers to remind them to upload bank statements, tax returns, or e-sign agreements.

Renewal & Upsell Outreach

Re-engage past borrowers or those nearing full paydown with new offers or upgrades.

Fund More Deals, Faster

Get applications completed and approved before competitors even follow up.

Handle Bank Statement Reminders Automatically

Call borrowers daily to request or remind them to upload required docs.

Update Borrowers on Application Progress

Give real-time voice updates on what’s next in underwriting.

Renew High-Quality Clients at Scale

Run outbound campaigns to re-engage existing borrowers for top-off or new funding.

1

Script Lending-Specific Flows

We help build voice logic for your funding funnel, doc collection, and renewal paths.

2

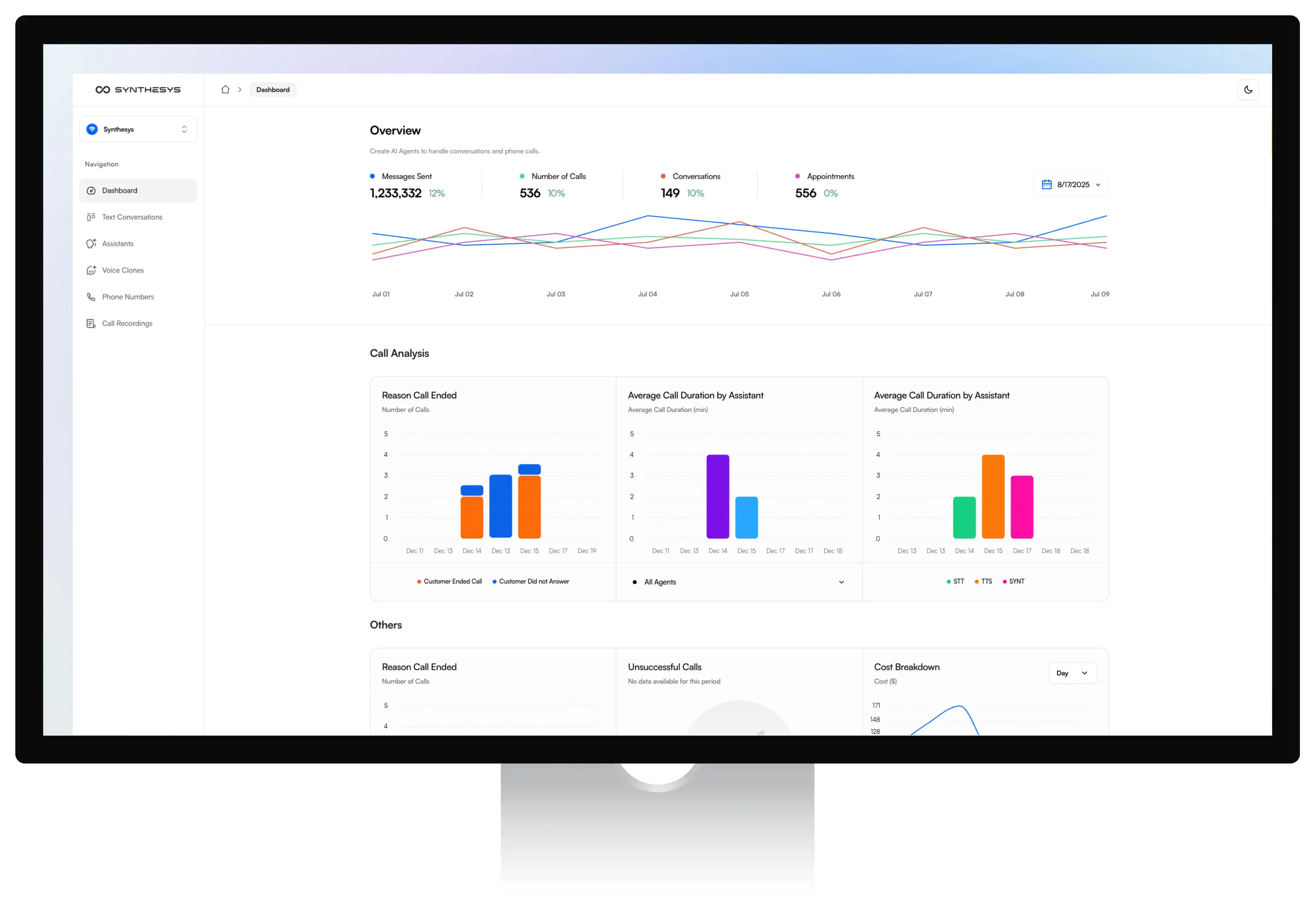

Integrate With Your Stack

Connect Synthesys to Salesforce, HubSpot, HighLevel, or your lending CRM.

3

Deploy in Days

Go live quickly with multilingual phone outreach and inbound support.

2–3x faster time-to-completion for borrower applications

Reduce underwriting doc drop-off by 40%+

Book more renewals through automatic re-engagement

Handle 80–90% of phone-based borrower communications automatically