AI Voice Automation for Financial Services & Banking

AI Voice Automation for Financial Services & Banking

AI Voice Automation for Financial Services & Banking

Accelerate customer interactions across lending, banking, and credit operations. Synthesys activates cards, qualify loan applicants, upsell products, and verify information instantly—with human-like tone, 24/7.

Accelerate customer interactions across lending, banking, and credit operations. Synthesys activates cards, qualify loan applicants, upsell products, and verify information instantly—with human-like tone, 24/7.

Some companies our

team has worked with:

HithisisMaddiefromAstraBank.Doyouhaveasecond?

Hey,yeahyousaidthisisMaddie?

Yes,that'sright.I'mMaddiereachingoutfromAstraBank.Thiscallisaboutyourpre-approvedcreditlimitincreaseoffer.Beforewechatfurther,Ineedtoreadyouaquickprivacyandrecordingnotice,OK?

Yeah,OK,goahead.

Thanks.Forservicequality,thiscallmayberecorded.We'llprocessyourdataperourprivacypolicyandapplicablelaw,includingGDPR,whererelevant.Doyouconsenttoproceed?

Yeah,that's fine.Go ahead.

Great.Thankyou.Forsecurity,couldyoupleaseconfirmthelast2digitsofyourdateofbirthandthelast 3digitsofyourEmiratesID?

Yeah,likethelast2digitsofmybirthyear?

Exactly,justthelast2digitsofyourbirthyearandthelast3digitsofyourpostalcodeorEmiratesIDplease.

OK,yeah,so it'sgonnabe93.Andthenwhatdoyouneedthelastfourdigits?

Justthelast3digitsofyourpostalcodeorEmiratesIDwilldo.Couldyousharethose?

Yeahsothat'sgonnabe031.

Thankyouforconfirming.Soyou'vebeenpre-approvedforacreditlimitincreaseonyourcurrentcard.There'snofeeandyourtermsstaythesame.Outofcuriosityisthereanythingyou'dusetheextrafundsformaybetraveloraspecialpurchase

Uh,Imean,justgotalotgoingonoverhere.Howmuchistheincreasefor?

Totallygetit,witheverythinggoingonhavingalargerbufferneverhurts.I'llsendyoutheexactamountandsummarybySMSrightafterwefinish,sinceIcan'trevealitovervoiceuntilyoureviewitsecurely.Wouldyouliketogoaheadandaccepttheincrease,orwouldithelpifitextyouthedetailssoyoucancheckthemlaterinyourapp?

Uh,youknow,it'sOKwecangoaheadanddoit,thenyoucantextitover.

Perfect.Couldyoupleaseopenyourbankingappnow,headto'Menu'thenselect'Offers'andlookforthe'CreditLimitIncrease'option.Letmeknowonceyouseeit.I'llwalkyouthroughthelaststeps

OK,yousaidmenuandthenda-da.OK,yeah,noigotthisup.

Great,you'realmostthere.Intheoffersection,youshouldseeacreditlimitincrease.Canyouspotthatoption?Ifso,justtapitandthenhitconfirm.Letmeknowonceyouseethesuccessmessage.

OK. ...Yeah,no,it'sconfirmed.

Awesome,yournewlimitisactiverightaway.I'lltextyoutheofficialsummary,includingthenewamountandallyourcurrentterms.Isthereanythingelseyouwanthelpwith?Maybesettingupspendalertsorbudgetingtools?

Uh,noit'sOK.Thanksthough.

Well,itwasgreatspeaking.Talktoyoulater.

Allright,byeMaddie.

Goodbye.

Solutions for

Solutions for

Solutions for

Financial Institutions

Financial Institutions

Financial Institutions

Card Activation & Setup

Automatically verify identity and activate credit or debit cards securely over the phone.

Loan Qualification

Pre-screen and qualify applicants in real-time, collecting necessary information for approval workflows.

Credit Product Upsells

Use intelligent prompts to offer higher-limit cards, personal loans, or new financial products.

Payment Reminders & Follow-Ups

Send proactive voice or SMS follow-ups for due payments, late fees, or account updates.

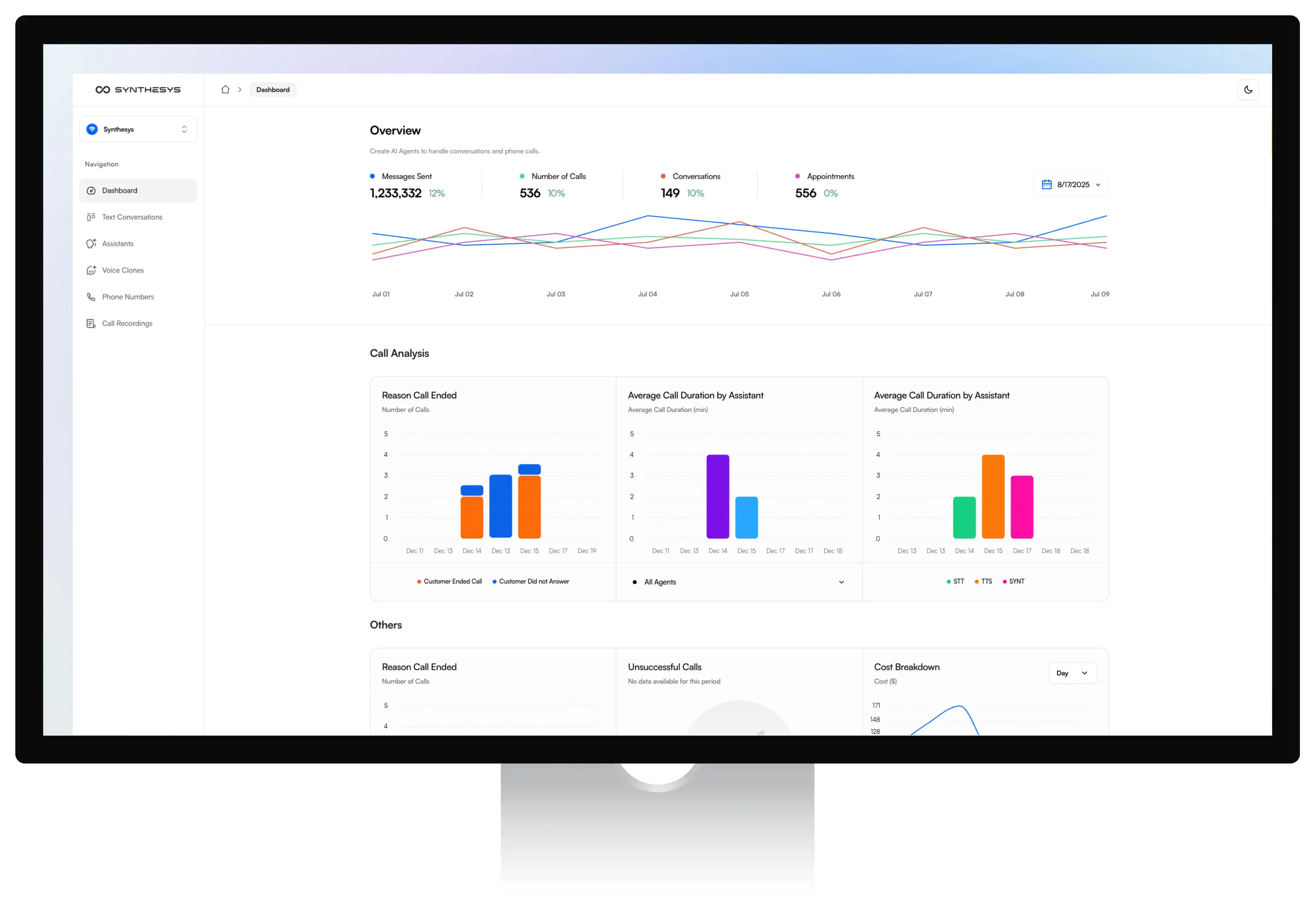

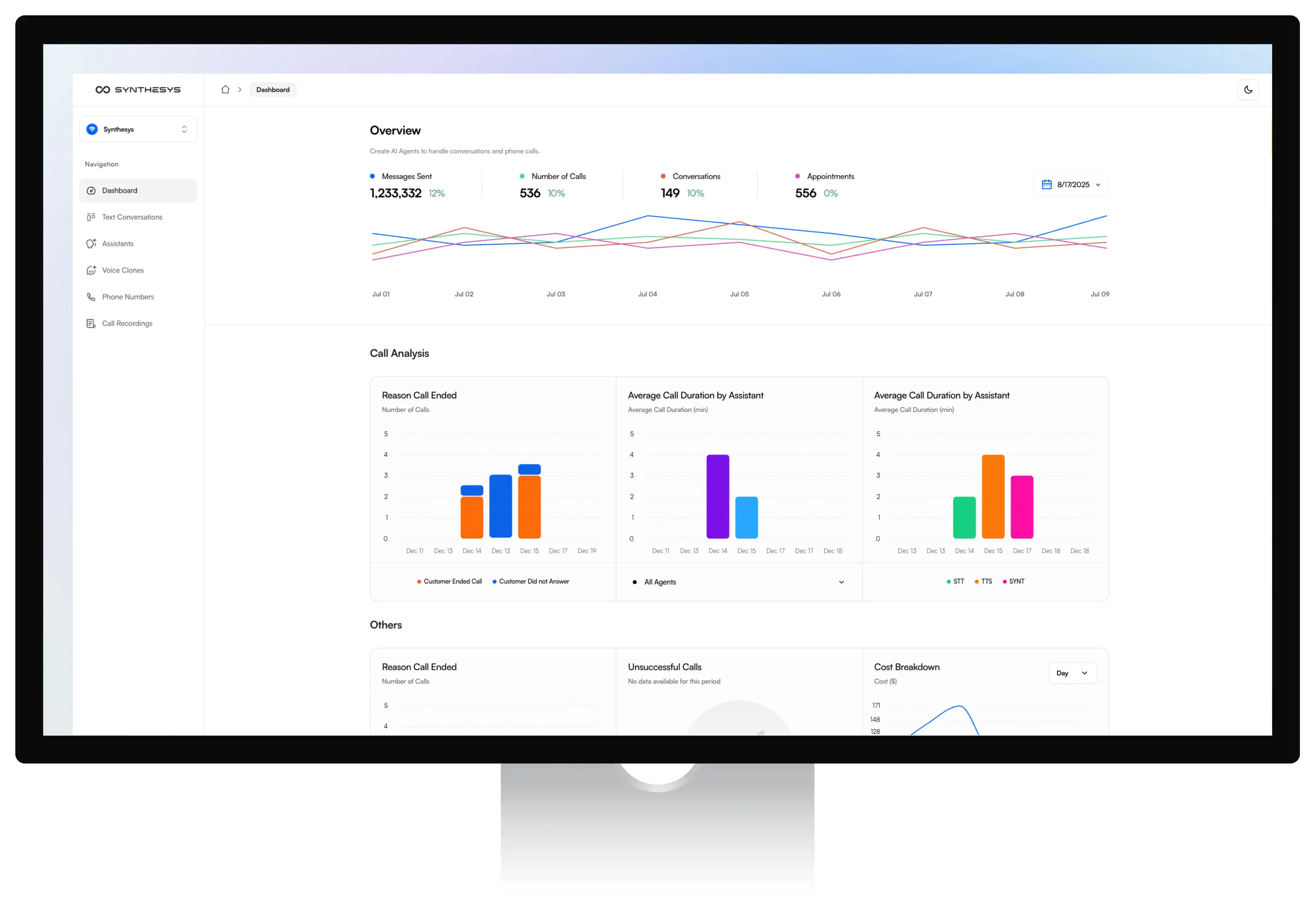

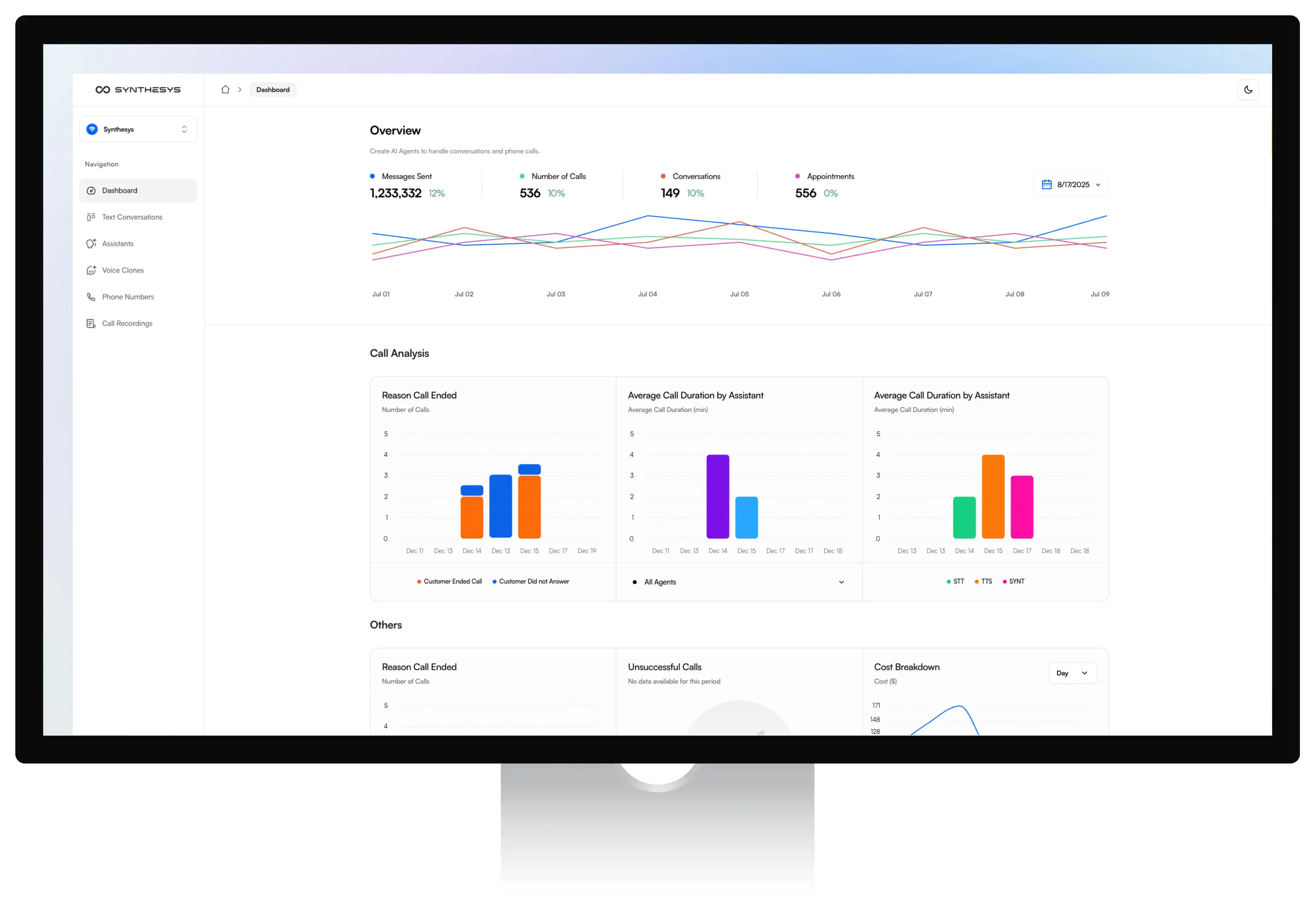

Scalable AI voice for regulated financial operations

Whether you're managing cardholder services, loan intake, or branch overflow, Synthesys delivers enterprise-grade voice automation that keeps you compliant and competitive. Financial customers expect real-time service, not hold music. Our platform answers inbound and outbound calls in under 500ms, understands 32+ languages, and securely integrates with your CRM, core banking system, or verification stack.

Synthesys is SOC 2 Pending, GDPR, and HIPAA compliant by design. We support redaction, encryption, call logging, and audit trails to meet internal risk and compliance standards across high-stakes customer interactions.

Scalable AI voice for regulated financial operations

Whether you're managing cardholder services, loan intake, or branch overflow, Synthesys delivers enterprise-grade voice automation that keeps you compliant and competitive. Financial customers expect real-time service, not hold music. Our platform answers inbound and outbound calls in under 500ms, understands 32+ languages, and securely integrates with your CRM, core banking system, or verification stack.

Synthesys is SOC 2 Pending, GDPR, and HIPAA compliant by design. We support redaction, encryption, call logging, and audit trails to meet internal risk and compliance standards across high-stakes customer interactions.

Scalable AI voice for regulated financial operations

Whether you're managing cardholder services, loan intake, or branch overflow, Synthesys delivers enterprise-grade voice automation that keeps you compliant and competitive. Financial customers expect real-time service, not hold music. Our platform answers inbound and outbound calls in under 500ms, understands 32+ languages, and securely integrates with your CRM, core banking system, or verification stack.

Synthesys is SOC 2 Pending, GDPR, and HIPAA compliant by design. We support redaction, encryption, call logging, and audit trails to meet internal risk and compliance standards across high-stakes customer interactions.

Real-World Applications

Real-World Applications

Real-World Applications

Instant Card Activation

Eliminate long hold times. Activate cards with secure ID verification via voice.

Loan Funnel Acceleration

Speed up time-to-decision with voice-based data intake and rule-based qualification.

Cross-Sell & Retention

Proactively offer balance transfers, new cards, or promotions during outbound campaigns.

How it works

How it works

How it works

1

Build Flows

We design custom call flows for your financial workflows: from KYC to loan pre-approval.

2

Integrate Securely

Connect to your CRM, telephony stack, and identity verification system via secure APIs.

3

Deploy & Monitor

Go live in 10–14 days with full analytics, tagging, and compliance logging.

Results you can expect

Results you can expect

Results you can expect

Activate cards in under 60 seconds, anytime, in any language

Pre-qualify loan applicants with 24/7 inbound voice screening

Increase cross-sell rates by 25%+ with outbound voice campaigns

Reduce live rep workload by 60%+ on transactional calls

Integrations for everything

Integrations for everything

Synthesys comes ready to run out of the box. But if your business needs more, our ecosystem of CRM, sales, and support integrations connects you to the tools you already use - with over 200+ apps for whatever specialized features you might need.

Integrations for everything

Synthesys comes ready to run out of the box. But if your business needs more, our ecosystem of CRM, sales, and support integrations connects you to the tools you already use - with over 200+ apps for whatever specialized features you might need.

FAQs

FAQs

FAQs

Is Synthesys secure and compliant with financial regulations?

Is Synthesys secure and compliant with financial regulations?

Is Synthesys secure and compliant with financial regulations?

Can it handle sensitive data like card numbers or SSNs?

Can it handle sensitive data like card numbers or SSNs?

Can it handle sensitive data like card numbers or SSNs?

Can we use Synthesys for both inbound and outbound campaigns?

Can we use Synthesys for both inbound and outbound campaigns?

Can we use Synthesys for both inbound and outbound campaigns?

What about multilingual support for our customers?

What about multilingual support for our customers?

What about multilingual support for our customers?

Can Synthesys verify identity for KYC or card activation?

Can Synthesys verify identity for KYC or card activation?

Can Synthesys verify identity for KYC or card activation?

Let Synthesys Handle the Phones

Let Synthesys Handle the Phones

Let Synthesys Handle the Phones

Scale your financial operations without scaling your team. Book a demo and see how voice AI transforms banking, lending, and card services.

Scale your financial operations without scaling your team. Book a demo and see how voice AI transforms banking, lending, and card services.

Platform

Partners

Solutions

Resources

Platform

Partners

Solutions

Resources

Platform

Partners

Solutions

Resources

Platform

Partners

Solutions

Resources